24 Oct Wired for waste: The billion-dollar deals powering Thailand’s energy surplus

Thailand is producing energy it doesn’t need at great cost to its citizens. One energy mogul benefits from the country’s long-term supply contracts. Khadija Sharife investigates

Thai billionaire Sarath Ratanavadi is the largest shareholder in Gulf Energy Development Public Company Ltd. Photo supplied

For Sarath Ratanavadi – one of Thailand’s wealthiest businessmen – relationships matter. He has met with American President Donald Trump, maintains a decades-long relationship with Thailand’s prime minister, and benefits from long-term government power contracts that pay in full even when plants are idle.

Already, Thailand’s power reserves remain far above the 15% norm, at 34% to 38% of 55,000MW in 2025 – more than 17,000MW in excess since 2020. In April 2025, peak demand hit 34,620MW (65% of capacity), exceeding the entire generation of neighbouring countries like Laos.

Gulf Energy Development Public Company Ltd, known as Gulf, is one of Thailand’s largest energy and infrastructure companies. Thailand has two private sources of energy producers: independent power producers (IPPs), which are large-scale producers, and small power producers (SPP).

Under Gulf’s IPP agreement with Thailand’s Energy Generating Authority (EGAT), the latter is “obliged to pay the full amount of the availability payment… as long as GULF has maintained the availability of the plant even if EGAT has not dispatched electricity from GULF’s IPP power plants…”

Under the SPP agreements, Gulf is entitled to 80% “availability payments” even when not dispatched. Those costs flow into end-user tariffs, the Thailand Development Research Institute has noted. Private concessionaires lock in price coverage via availability-payment mechanisms. Regardless of actual demand, contracted costs are passed through to consumers.

The result: the state pays whether or not the electricity is used – and citizens ultimately bear the charges.

EGAT’s own capacity is listed at 16,261.02MW, or 29.1% of Thailand’s total installed capacity. Across all energy sources Gulf’s 2024 annual report recorded power generation capacity of 16,476MW in Thailand with the remainder generated by the RATCH Group in partnership with Gulf.

A significant share of these obligations stems from long-term supply deals with Gulf, where Ratanavadi is the largest shareholder. Gulf directly holds LNG shipper licences; and is partnered with PTT, another state entity in multiple gas storage and distribution ventures including terminals.

Gulf sells almost all of its electricity to EGAT under long-term contracts averaging 25 years, generating more than $3.5-billion in annual revenue for Gulf from state-linked counterparties. By December 2017, Gulf went public, listing its stock which centred on Ratanavadi’s natural gas portfolio, comprising an estimated 93% of total power by 2023. According to their filings, the company gives about 90% of its equity capacity to EGAT.

Thailand’s LNG gas imports have, according to Standard and Poor’s ratings, increased 40% “year on year” since 2023, requiring liquification, shipping and regasification – driving high electricity costs compared to gas produced from neighbouring countries.

EGAT’s own data cited by analysts show three of four Gulf plants among the most expensive on a cost-per-watt basis. Gulf’s dominance appears even starker in contracted capacity among the state’s leading suppliers.

Thailand’s Power Development Plan (PDP) – the state’s road map for generation and procurement – locks in future energy deals. Oxpeckers received evidence that two former Gulf officials were responsible for key decisions relating to energy strategy that ultimately, and directly, profits Gulf.

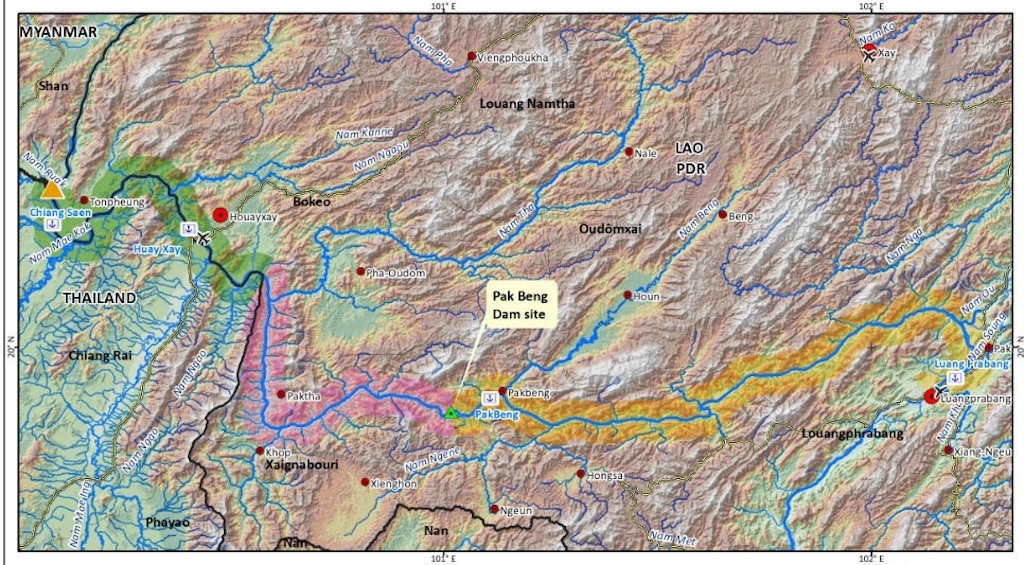

Thailand’s hydropower agreements ultimately rest on the authority of the Lao government, which holds territorial sovereignty over the Mekong river. Photo supplied

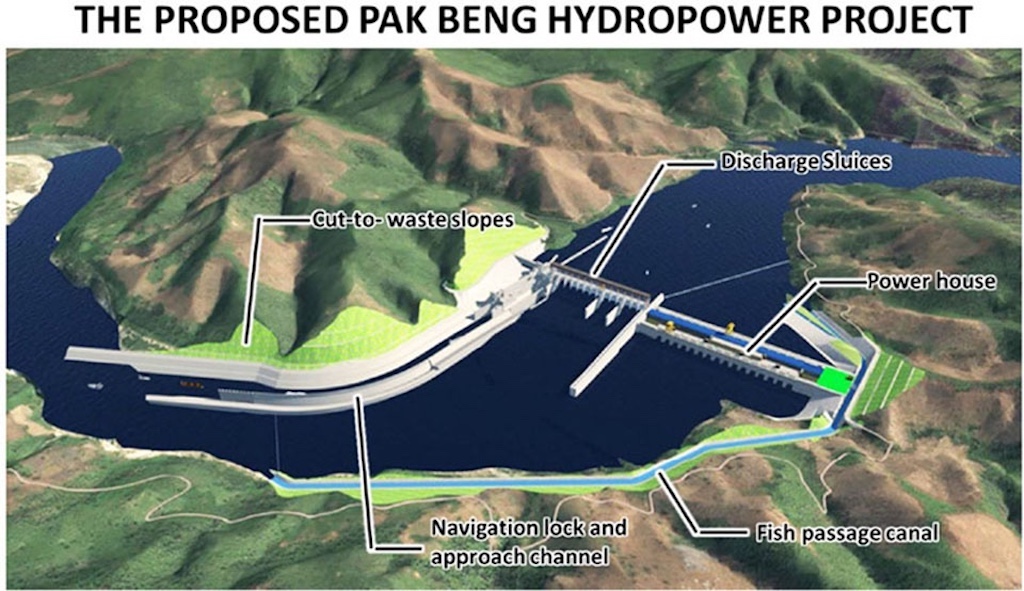

Pak Beng’s development carries an estimated price tag of at least $1.88-billion. Graphics supplied

Hydro projects

In early 2017, Thailand set its sights on expanding its energy frontiers with two ambitious hydropower ventures – Pak Beng (900MW) and Pak Lay (770MW) – together promising an additional 1,600MW of electricity for the national grid. Conceived as eight-year undertakings, the dams were slated to begin operations in 2022 and 2023, marking a new phase in cross-border energy cooperation along the Mekong river.

While Thailand remains the principal buyer of electricity, the agreements ultimately rest on the authority of the Lao government, which holds territorial sovereignty over the Mekong river.

Under 29-year power purchase agreements, electricity from both projects was priced between 2.69 and 2.71 THB per kilowatt-hour. The Pak Beng project emerged as a partnership between Gulf Energy Development, led by Thai billionaire Ratanavadi (49%), and China Datang Overseas (51%).

Estimated to generate $306.7-million (around THB 9.95-billion) in revenue annually, Gulf’s share amounts to roughly $150.3-million – a significant return for its minority stake and roughly $4,35-billion over the life of the project.

The story of Pak Lay took a different turn. On June 22 2025 Ratanavadi moved to consolidate control, acquiring former owner Sinohydro’s 60% stake for $128-million, financed through shareholder loans and equity. The project’s estimated revenue stands at $270.3-million (about THB 8.76-billion), or a total revenue of $7,83-billion over the life of the project.

Pak Beng’s development carries an estimated price tag of at least $1.88-billion, while Pak Lay’s stands at $2.13-billion – sums that must be locked in before the projects reach their financial close.

After a September 21 2023 filing noted that Lao had approved Pak Beng and the project was “in the process of securing loans”, with financial close expected by the end of 2024, silence followed.

Neither the company’s 2024 nor 2025 disclosures confirm that the deal ever received Lao approval or secured financing before the final extended closing deadlines. Instead, each formal filing through August 2025 continued to categorise Pak Beng – and its sister project Pak Lay – as still “under development”.

Leaked documents – corroborated by insider accounts – suggest that, contrary to Gulf’s official disclosures, the Lao government may never have granted final approval for the project, nor was financing secured by Pak Beng’s termination date in April 2025.

Cover page of the EGAT report obtained. Related documents are available for viewing here

Internal reports

Internal reports from EGAT and the Ministry of Energy show that although the Lao government signed concessionaire agreements with the project developers in February and August 2023, the projects remained in limbo. By March 22 2024, the Lao National Assembly was still reviewing the deals – a delay that sources told Oxpeckers effectively stalled financial closure. Pak Lay’s financing deadline passed in March 2024, and Pak Beng’s followed in November 2024, as penalties began to mount.

By early May 2024 Thailand’s coordination committee, operating within the Ministry of Energy, met to deliberate the guidelines for extending the deadlines and assigned EGAT to negotiate with Gulf and its partner on termination of the project should the loans not be secured in time. Higher fines, implemented daily, were imposed.

By September 2024 negotiations began with EGAT and key government units for extended financial deadlines, and by October Gulf communicated new financial deadlines to EGAT. In late October EGAT sent a letter asking the Attorney General whether EGAT was in a position to terminate and whether it was required to approve extensions through a “special financial closing date”. By December 2024 an extension was formally considered and a request was brought to the EGAT board to approve a timeline extension. Supporting documents confirming details were requested for EGAT’s board.

In late April 2025 a letter titled “most urgent” was authored by Pirapan Salirathavibhaga, at the time both minister of energy and the deputy prime minister of Thailand. In it, he cited the lack of approval from the Lao government and raised whether this would be a cause for extending the already extended financial closing dates as well as the operational start date. (At the time of publication, Salirathavibhaga is no longer the minister of energy.)

A copy of the EGAT extension agreement shows that the financial deadlines were extended in 2025.

Salirathavibhaga requested an update in April 2025 about whether the projects would be terminated. On April 30 2025 a senior official at EGAT responded to Salirathavibhaga saying that Pak Beng had successfully reached its April closing date – secured the loan which necessitated Lao’s approval – and there was no need to terminate to amend the contract. Pak Lay’s extended financial closing date – September 11 2025 – had not yet expired and was in the process of securing financing.

Salirathavibhaga followed up requesting access to the documents, including Lao’s approval and proof of financing. Another senior EGAT official responded that Gulf had stipulated the documents were confidential and could not be shared. Oxpeckers has learned that even EGAT’s board allegedly did not have access to supporting documents.

There is no evidence that Ratanavadi himself deliberately withheld documentation from relevant government authorities and bodies. Gulf, EGAT, the Energy Regulatory Commission and the former Minister of Energy did not respond to questions posed by Oxpeckers at the time of publication, nor did Lao’s National Assembly.

Gulf Energy Development recently filed defamation suits against two members of parliament, accusing them of making false claims about electricity pricing and energy procurement. The company is demanding substantial compensation – reportedly just over $3-million from each defendant – for alleged reputational damage. The contested remarks stem from parliamentary debates and public statements in which the MPs alleged Gulf and the government of opaque practices and inflating energy costs. Gulf has reportedly said that these statements exceed the bounds of protected speech and have harmed its business interests.

• Find documents related to this investigation here

Khadija Sharife is an investigative journalist and writer. She is an Oxpeckers advisor, and previously served as a global journalist with the Organized Crime and Corruption Reporting Project (OCCRP)