20 Jun Running on empty: Mpumalanga’s energy transition needs juice

Despite its resources and capacity for green energy storage, the province at the heart of the energy transition reaps minimal benefits due to an export-heavy focus. Sakhile Dube investigates

Critical mineral: South Africa ranks as the third-largest global producer of vanadium. Photo © Bushveld Minerals

As South Africa transitions from coal-powered energy to renewable resources such as solar and wind, the success of green energy technologies depends on the integration of battery and energy storage solutions.

The energy heartland of the transition, Mpumalanga province, has a wealth of critical minerals needed for green energy storage – nickel, copper, cobalt, vanadium and manganese – but most of these resources are being exported.

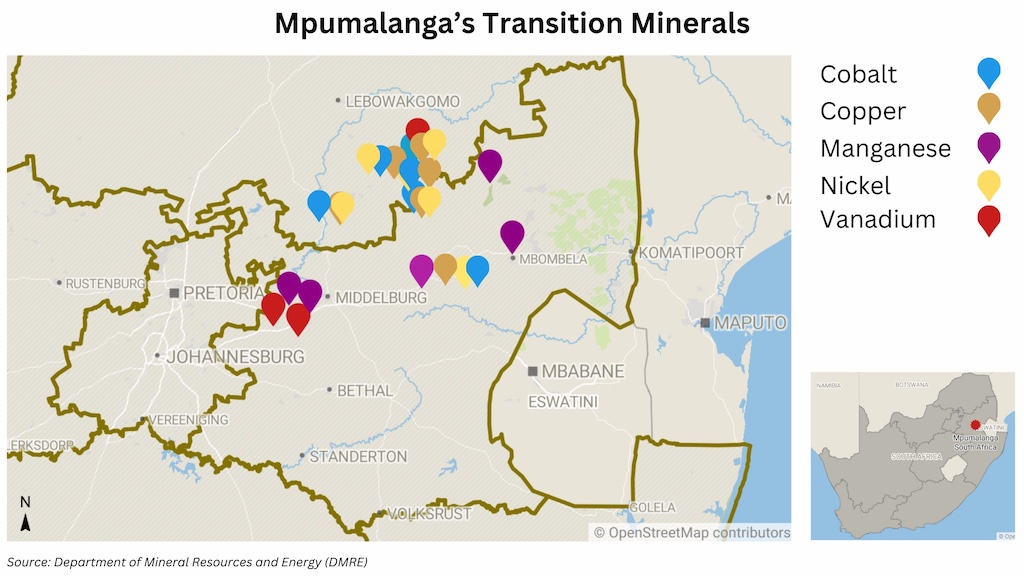

According to the 2024 database of the Department of Mineral Resources and Energy, Mpumalanga has 13 mines and companies trading in transition minerals. Oxpeckers research indicates some are indirectly involved in renewable energy storage solutions while others are under care and maintenance.

Among these, the Nkomati Mine in Machadodorp stands out with its substantial nickel reserves, making it one of the country’s key nickel producers. The Manganese Metal Company (MMC), based in the provincial capital, Mbombela, is the leading producer of high-purity electrolyte manganese metal, a critical component for electric vehicle batteries.

South Africa ranks as the third-largest global producer of vanadium, with companies such as Bushveld Energy and its facility in Mpumalanga playing a significant role in vanadium production. Bushveld recently announced plans to sell its primary vanadium producing company, Vanchem, for up to US$40.6-million.

DMRE 2024 data shows Mpumalanga has 13 mines and trading companies producing minerals critical for energy storage systems. While some of the mines are based in Limpopo province, their resources contribute to Mpumalanga production. Map by Sakhile Dube

International markets

Mikhail Nikomarov, chief executive of Bushveld Energy, said there is significant potential for future development and investment in transition minerals in the province, but the local producers are mostly serving international markets despite the growing local demand for energy storage systems.

“Most vanadium produced in South Africa is exported, primarily for use in steel, with only about 10% used domestically. Nickel, traditionally used for plating, has only recently been used in batteries, and the majority of it is exported,” said Nikomarov.

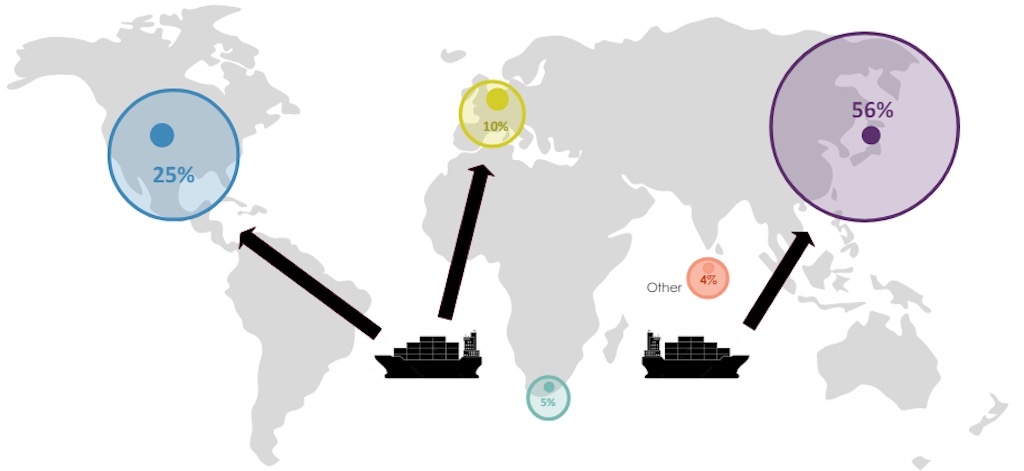

MMC is a major international exporter of electrolyte manganese metal, for various uses including lithium-ion batteries. Louis Nel, its chief executive, said “approximately 95% of our production supports international markets such as Europe, North America. This leaves only about 5% of production benefiting the local market.”

MMC’s manganese export destinations. The trend is similar to other transition minerals, with more than 90% being exported, leaving only a minimal benefit for local use. Map courtesy Manganese Metal Company

Imported kits

Traders producing battery packs and assembling energy storage systems tend to rely on imported kits rather than manufacturing them locally. These components are produced by international companies using some of the critical minerals originally exported from Mpumalanga, highlighting a significant gap in local manufacturing capabilities and supply chains.

Nikomarov pointed out that the lack of a large domestic market to drive economies of scale makes it harder for Mpumalanga to compete in the renewable energy storage solutions sector. While there is a competitive advantage in vanadium, manganese and nickel, the province loses that advantage when moving further down the value chain, such as manufacturing.

“While there is a significant demand for energy storage solutions, the local supply chain is underdeveloped,” he said.

The province needs more large-scale manufacturing facilities, Nikomarov added. His company is a key contributor in the development of vanadium redox flow batteries for large-scale energy storage and has an electrolyte manufacturing facility located in Emalahleni in Mpumalanga – home to 12 coal-fired power stations and 142 renewable energy projects, according to #PowerTracker data.

Providing incentives for local production and investment in renewable energy storage is essential, MMC’s Nel said. “Implementing trade restrictions or tariffs on imported items could encourage local production, though this must be balanced against potential cost increases,” he said.

Nikomarov suggested government policies should enforce higher local content requirements for certain transition technologies to support local manufacturing. “We could introduce policy incentives, like those in other countries and those for businesses located in industrial development zones,” he said.

Offering other incentives such as meaningful tax breaks for businesses could also encourage local production, Nikomarov suggested. The current tax incentive that allows individual consumers and businesses to reduce their taxable income on the cost of renewable energy assets for electricity generation has been increased from 100% to 125%, “but the cap is too low to be impactful for businesses”, he said.

Processing vanadium. The mineral is used in the production of redox flow batteries for large-scale energy storage. Photo © Bushveld Minerals

Capital investment

Natasha Ross, a senior lecturer in the department of chemistry at the University of the Western Cape, told Oxpeckers that setting up manufacturing plants for renewable energy storage production requires significant capital investment.

She cited an example of Bushveld Minerals’s partnership with the Industrial Development Corporation on a project to build a flow battery electrolyte plant in East London. More of these type of investment partnerships are needed in Mpumalanga, she said.

Determining whether it is more competitive to manufacture locally than to import components is complex and multifaceted, Ross said. It involves assessing factors such as cost efficiency, technological capability, supply-chain infrastructure and market demand.

“On one hand, local manufacturing could reduce dependency on imports, create jobs and stimulate the economy. On the other hand, it requires substantial investment in technology, skilled labour and infrastructure, which might not be immediately available or cost-effective,” she said.

Competitive advantage: Leveraging growing demand, existing skills and its strategic location, manufacturing in Mpumalanga has the potential to provide jobs. Photo: Sven Musica

Higher-level skills

Nikomarov said there is a lack of research and development expertise and higher-level skills that could provide solutions for using critical minerals for the benefit of the province.

Boosting the local economy, generating jobs and enhancing skills can only be done with the support of relevant stakeholders able to build manufacturing facilities, he added. “While labour costs might be lower than in Europe, they are not cheaper than in India.

For Mpumalanga to be competitive as a region, “we need to look at where we have a competitive advantage and focus on specific parts of the supply chain rather than the entire chain”, he advised.

With sufficient government support, cell manufacturing could become feasible, Nikomarov said, though manufacturing cathode active material, lithium salts and separators – foundational to the performance, safety and scalability of lithium-ion batteries – would be challenging due to the required scale and technological expertise required to succeed.

Gaylor Montmasson-Clair, a senior economist at independent research institution Trade & Industrial Policy Strategies, told Oxpeckers that securing investment in renewables manufacturing requires competitiveness on both national and global scales. Investors tend to favour economic centres such as large metropolitan areas and coastal locations with proximity to ports.

“Substantial manufacturing investment in Mpumalanga would require an exceptionally conducive environment, including decisive policy support,” Montmasson-Clair said.

Energy-intensive: The process of extracting and refining critical minerals is heavily reliant on electricity, and is becoming increasingly costly. Photo: Sven Musica

Untapped opportunities

While there are untapped opportunities, building local manufacturing facilities often takes years. Amid pressures to shut down coal-powered plants in the province to meet global climate crisis commitments, time is not on the side of the transition traders.

Nel pointed out that the process of extracting and refining critical minerals is heavily reliant on electricity.

“Producing manganese is highly energy-intensive and is becoming increasingly costly due to rapidly rising electricity prices in South Africa,” he said. “The energy-intensive nature of the production process is squeezing profit margins and making it increasingly challenging to remain competitive in the local market.”

Nel said the province could benefit from upstream mineral mining, beneficiation – enhancing ore value by removing unwanted minerals – and smelting and refining. Focusing on the development of the raw ingredients used to manufacture the active materials in batteries and other components where Mpumalanga has a competitive advantage, such as vanadium and nickel processing, could strengthen the local supply chain.

However, these ambitions all require extensive research and development, he said.

“At the moment there is a lack of substantial research. Ideally, we would look to universities to conduct more studies on nickel and its applications, as well as further research on vanadium,” Nikomarov added.

MMC’s plant in the provincial capital. The refining process of manganese is required to meet strict environmental regulations. Photo: Sven Musica

New environmental challenges

Scaling up renewable energy storage solutions comes with some new environmental challenges. As the producer of about 80% of South Africa’s coal and with its high concentration of Eskom plants, Mpumalanga already suffers air and water pollution, biodiversity loss and other impacts of fossil fuel production.

In response to the new challenges, in 2023 the Department of Environment published its intention to exempt certain activities associated with the development and expansion of battery storage facilities from the red tape involved in obtaining environmental authorisation.

The exemption would apply to activities in areas described as “of low or medium environmental sensitivity”. Critics say while it will simplify the process of implementing renewable energy and storage projects, it raises concerns around non-compliance.

The mineral refining process of manganese, for instance, generates various waste products that may contain residual metals or chemicals. The disposal of these byproducts is required to meet strict environmental regulations as disposal in landfills has the potential to contaminate soil and groundwater with heavy metals and other pollutants. Landfills occupying large areas of land can also displace inhabitants and potentially impact biodiversity.

Green fingers: Addressing the environmental and social impacts of transition mineral production is crucial. Photo © MMC

Technical work

“To address the issue of landfills, we have completed the technical work on producing clay bricks and cement fibres made from manganese byproducts. We have also conducted environmental work, including leaching tests, to ensure safety,” Nel said.

Nel pointed out that the challenge now is commercialisation: “We need to produce a large number of bricks for industrial buyers, along with provincial and local governments, who are crucial customers. Unfortunately, the market for cement fibres will depend on the government’s support,” he said.

The manufacturing process for vanadium batteries involves handling sulphuric acid and waste materials, necessitating strict environmental compliance to prevent contamination and ensure safety.

Addressing these environmental and social impacts is crucial as the region develops its manufacturing renewable energy and storage capabilities, said Nikomarov.

This investigation by Sakhile Dube, a freelance journalist focusing on renewable energy and climate change, was supported by the Oxpeckers #PowerTracker project and the African Climate Foundation’s New Economy Hub.

- You can track the development of energy projects across Mpumalanga province on the Oxpeckers #PowerTracker tool