25 Oct Mpumalanga joins the green hydrogen shift

The HySHiFT project at Secunda is pioneering sustainable aviation fuel to help meet South Africa’s industry decarbonisation goals. Thabo Molelekwa investigates

Sasol will use green hydrogen at its existing facilities to produce enough e-kerosene to fuel two flights between Germany and South Africa a day. Photo courtesy Sasol

In the quest for cleaner and more sustainable energy sources, South Africa is emerging as a key player in the global green hydrogen (GH2) transition. With its commitment to reducing carbon emissions, a strategic focus on hydrogen production is aimed mainly at the decarbonisation of industry, according to experts.

One of the leading GH2 projects is taking shape in Mpumalanga province, where the HySHiFT renewable hydrogen project is developing sustainable aviation fuel, or e-kerosene. The aviation industry is responsible for about 12% of global transport emissions and HySHiFT aims to find ways to reduce its carbon footprint, according to the project partners.

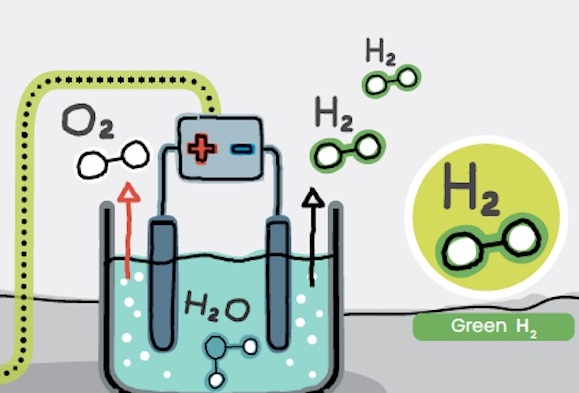

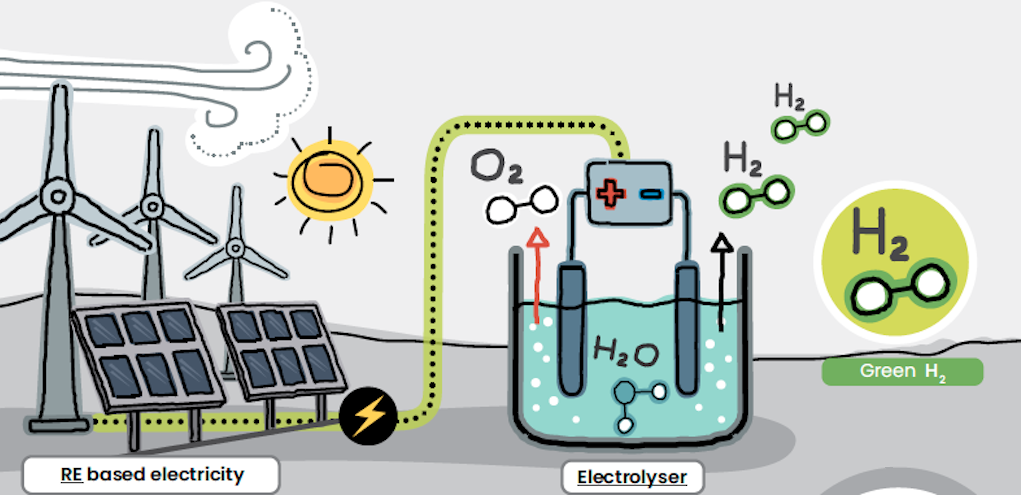

In 2022 a consortium comprising Sasol, Enertrag, Linde and Hydregen announced they would use energy sources such as wind and solar to power 450MW of renewable electricity and a 200MW electrolyser needed to split water into oxygen and hydrogen. This green hydrogen would be used in Sasol’s existing facilities to produce enough e-kerosene to fuel two flights between Germany and South Africa a day, they said.

The German government has pledged a grant of €15-million (about R300-million) to the project, which is being developed at Sasol’s Secunda operations in Mpumalanga.

The project will use renewable energy to power an electrolyser that splits water molecules into oxygen and hydrogen. Graphic courtesy Talking about Green Hydrogen

Hard-to-abate sectors

“We are confident that green hydrogen is key to decarbonising various hard-to-abate sectors, as well as the transport sector,” Sasol president and CEO Fleetwood Grobler told Oxpeckers.

“At our Sasolburg operations, we have successfully commissioned a 3MW solar farm that powers existing electrolysers. We have already achieved daily production of approximately 150kg of green hydrogen during the plant’s commissioning phase,” Grobler said.

In the near term, this will be bolstered by a further 69MW wheeled from the Msenge Emoyeni wind farm in the Eastern Cape, he added. “We expect this to come online in 2024 and it will enable our Sasolburg electrolysers to produce up to 5,500kg of green hydrogen a day.

“Having reached this historic milestone, much more work is to be done, which includes developing the regulatory environment in which green hydrogen mobility can thrive.”

On October 19 the South African Cabinet approved implementation of the Green Hydrogen Commercialisation Strategy, which aims to position the country as a major producer and exporter of GH2. The government has estimated that the hydrogen economy has the potential to add 3.6% to gross domestic product by 2050 and create 370,000 jobs.

Sasol CEO Fleetwood Grobler: ‘We are confident that green hydrogen is key to decarbonising various hard-to-abate sectors, as well as the transport sector.’ Photo courtesy Sasol

Decarbonisation goals

According to Charlotte Mokoena, executive vice-president at Sasol, GH2 is expected to play a critical role in South Africa’s decarbonisation goals beyond 2030.

“As we implement our decarbonisation progammes and transition to sustainable energy sources, this will have a direct impact on our workforce, communities and value chain,” she told Oxpeckers. “It is imperative that we build the resilience of our communities and employees to ensure we sustain livelihoods and thrive as the transition unfolds.”

Mokoena said the just energy transition is a complex undertaking which necessitates a collaborative approach. “The availability of funding, skills and capacity to deal with this massive challenge resides across our ecosystem, and beyond that it must be tackled together. We need to leverage partnerships to realise impact beyond the scale, and Sasol, together with our partners, is taking a lead in shaping the development of South Africa’s green hydrogen ecosystem.”

Mokoena said Sasol is accelerating developments in the emerging GH2 economy, ranging from renewables procurement to pre-feasibility studies with the government on both greenfields and brownfields projects. “This includes a large-scale export-orientated GH2 project in the Northern Cape, production of sustainable fuels from GH2 in our Secunda and Sasolburg facilities, hydrogen mobility, and the supply of GH2 for steel production.”

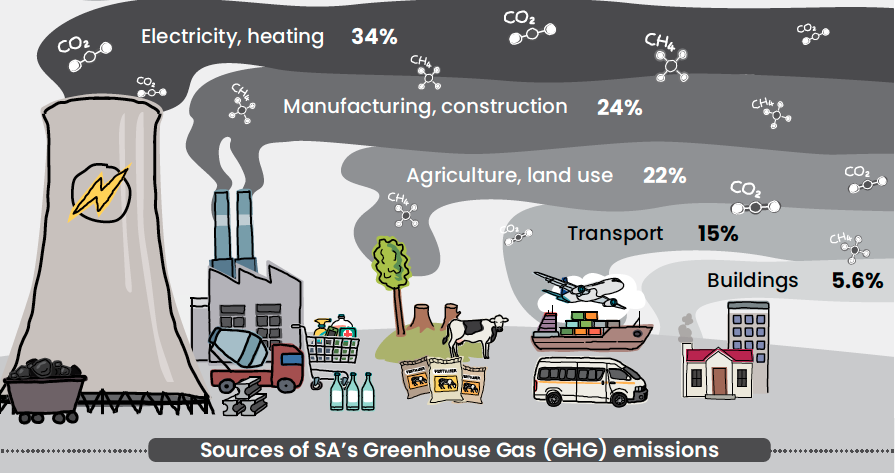

Hard-to-abate sectors such as manufacturing, construction and the petrochemical industry contribute to 24% of South Africa’s harmful greenhouse gas emissions. Graphic courtesy Talking about Green Hydrogen

Heavy industry

Speaking to Oxpeckers during the South Africa Green Hydrogen Summit from 16 to 17 October, Joanne Bate, the chief operations officer of the Industrial Development Corporation (IDC), the state-owned development finance institution and implementing agency of industrial policy, explained the importance of GH2 in the energy transition.

“We’re looking at hydrogen for decarbonisation of industry, including the petrochemical industry, and for new export products, specifically sustainable aviation fuel. The key role of IDC has been driving the commercialisation strategy and providing project development funding to some of the early-stage projects in the GH2 value chain,” Bate said.

“A lot of heavy industrial processes like steel manufacturing require very high levels of heat in the manufacturing process, and what makes hydrogen very efficient in that process is that hydrogen has a very high heat point.”

She said the industrialised triangle of Secunda in Mpumalanga, Sasolburg in the Free State and Vanderbijlpark in Gauteng “is where the hydrogen for decarbonisation of existing industry becomes very important. Sasol has the top technology used to proceed to produce synthetic fuels, so that’s currently the priority project.”

The reason GH2 is a priority, she added, is that “we will lose our manufacturing or heavy manufacturing industrial base if we don’t decarbonise it by between 2028 and 2030. The only reasonable means of decarbonising is through GH2 because they’re very high heat-intensive processes and green hydrogen is the most effective way of decarbonising this.”

She pointed out that in Japan, which is heavily dependent on coal-fired power stations like South Africa is, “they’re importing a significant amount of coal, but they are also looking at using ammonia, which is the derivative of GH2, in order to feed their coal-fired power stations”.

There’s potential for hydrogen to be used in different applications, including keeping power stations open “because you’re using the ammonia instead of coal”.

Bate emphasised that the big shift in the energy conversation is that it’s no longer just about coal and electricity. “It has to be about the chemical industry, which will allow the Mpumalanga province to create new jobs,” she said.

The IDC’s Joanne Bate (left) and Mahandra Rooplall at the South Africa Green Hydrogen Summit. Photo: Thabo Molelekwa

Early-stage projects

In 2022 the IDC signed a memorandum of understanding with German state-owned investment and development bank KfW to assist early-stage projects with grant funding to help accelerate the development of GH2. Part of the MOU was an agreement that will enable the IDC to manage €23-million in grant funds from the German government.

“IDC is looking at a number of GH2 projects. We are one of the few development banks internationally that offers project development funding,” Bate said.

However, she added that South Africa does expect significant foreign direct investment into the projects. “We really do want to ensure that there is foreign direct investment whether it comes in the form of equity. We’re not really concerned about what that equity looks like.”

Mahandra Rooplall, IDC’s industry development planner who is working on the national hydrogen commercialisation strategy for South Africa, said there is a global race to establish developing countries as GH2 hubs to supply export markets.

“If we come too late to the party, those markets will be tightened up and we will have lost the opportunity for the country. So it is about ensuring that we reach commercial scale quickly enough to ensure that we decarbonise and protect our industry, and also take a meaningful role in the hydrogen economy,” he told Oxpeckers.

SA-H2 Fund

In June this year the SA-H2 Fund was launched, an innovative blended finance fund that aims to to secure US$1-billion to accelerate the development of the GH2 sector in South Africa. The fund is supported by Climate Fund Managers and Invest International BV (II) of the Netherlands, Sanlam in South Africa, the Development Bank of Southern Africa (DBSA) and the IDC, in collaboration with other strategic partners.

In a statement released by the DBSA on the day of the launch, Andrew Johnstone, CEO of Climate Fund Managers, said: “To achieve Net Zero by 2050, urgent and unprecedented action is needed. We believe that GH2 is both the pathway and the solution to the global energy transition.

“South Africa combines deep technical and capital markets with world-class conditions for generating renewable electricity through solar and wind power, key drivers in the production of green hydrogen. Fitting within the framework of the just energy transition, SA-H2 will help empower South Africa to claim its rightful place as a world leader in this exciting and necessary sector.”

The SA-H2 Fund would join the SDG Namibia One fund, which aims to secure US$1-billion in funding for Namibia’s GH2 development, as “the second-of-its-kind, regional blended finance fund to develop and fund GH2 projects”, Johnstone said.

“Succeeding in a just transition to cleaner energy rests on our ability to create a viable marketplace that attracts and mobilises public and private capital,” said Catherine Koffman, group executive: project preparation at the DBSA.

“We will create and use innovative blended finance architecture and structuring to build a substantial pipeline of GH2 projects in South Africa. This will give private-sector developers access to risk capital from an early stage of development, throughout construction and into operations.”

Thabo Molelekwa is an associate journalist of Oxpeckers Investigative Environmental Journalism, and a graduate of our #PowerTracker professional support and training programme. This investigation was supported by the African Climate Foundation’s New Economy Campaigns Hub